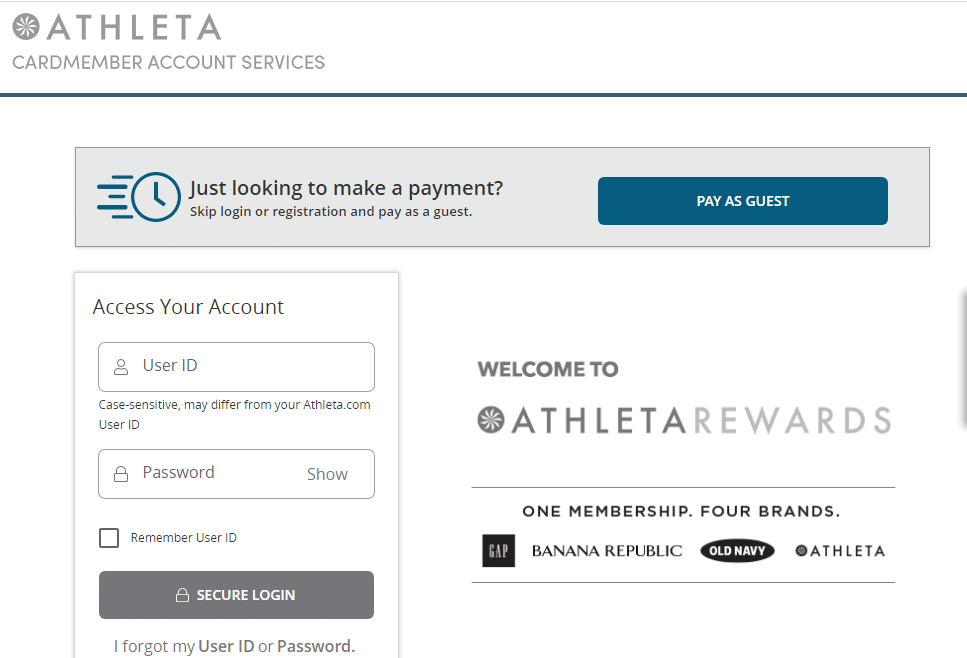

How to Make Athleta Credit Card Login

The login process for the Athleta Credit Card is very easy and hardly takes a few minutes of your time.

The Athleta Credit Card is a good retail card that helps customers to earn points for the purchases they make using the card. If you are the type who does a good amount of shopping at this store, then this card is ideal for you.

The Athleta Credit Card is a good retail card that helps customers to earn points for the purchases they make using the card. If you are the type who does a good amount of shopping at this store, then this card is ideal for you. The reward points can be converted to cash value certificates and used at the Athleta Stores.

The login process for the Athleta Credit Card is very easy and hardly takes a few minutes of your time.

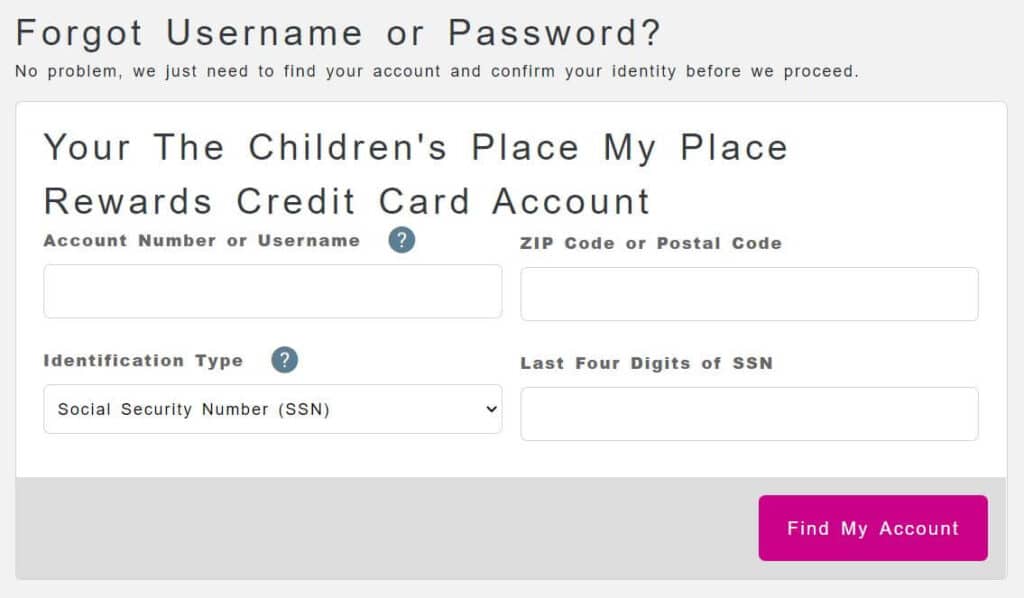

Forgetting passwords for credit cards is quite a common thing for many customers. However, one can easily reset their password by following these simple steps.

There are some simple steps that you can follow for applying for the Athleta Credit Card.

For making payments for Athleta Credit Card, multiple modes are available for the customers. one can make the payment in the online mode, or via mail or phone by calling the customer service number of the credit card company.

Athleta Credit Card Payment Online

For making the payments for the credit card online, follow these steps:

You can also make a credit card payment via phone. For making payments via phone,

call 855-327-4359.

Athleta Credit Card Customer Service Number For Payment

The customer service number for Athleta Credit Card is

855-327-4359.

Athleta Credit Card Payment By Mail

For making payments via mail, you can send the amount to the below-mentioned address of the company.

Athlete Credit Card

PO Box 960017

Orlando FL 32896

There are multiple benefits of the Athleta Credit Card. Some of them are mentioned below:

The Athleta Credit Card is a cashback card and hence one can get a percentage of the purchases in the form of cashback rewards.

There is no signup bonus offered to the customers.

There is no provision for the annual loyalty bonus.

There is a foreign transaction fee of 3% for this credit card. So if you are planning to travel abroad, you can leave this card behind and opt for a card that does not charge a foreign transaction fee.

You need to have a credit score of 630 if you want to apply for a credit card. Their APR rate is very high. So if you want to apply, maintain this credit score. Having a credit score of more than 630 will increase your chances of getting approval for the credit card.

Provide clear contact information, including phone number, email, and address.

Powered by Citi, the Shell Credit Card is designed for individuals who frequently purchase fuel at Shell stations and want to earn rewards and savings on gas and everyday purchases.

Powered by Capital One, the Kohl's Credit Card is designed for dedicated customers of the retail chain who seek exclusive promotions and easy access to manage their account online.

Powered by Barclays Bank, the Barclays Credit Card is designed for individuals who seek a seamless online credit card management experience with added travel and rewards benefits.